change in working capital formula cash flow

Looking for more details on the operating cash flow formula. Actual working capital decreases.

Net Working Capital Definition Formula How To Calculate

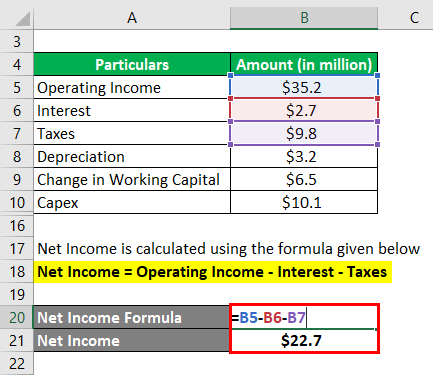

Net Income is calculated using the formula given below.

. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value. Non-cash working capital 1904 335 - 1067 - 702 470 million. Change in Net Working Capital 5000.

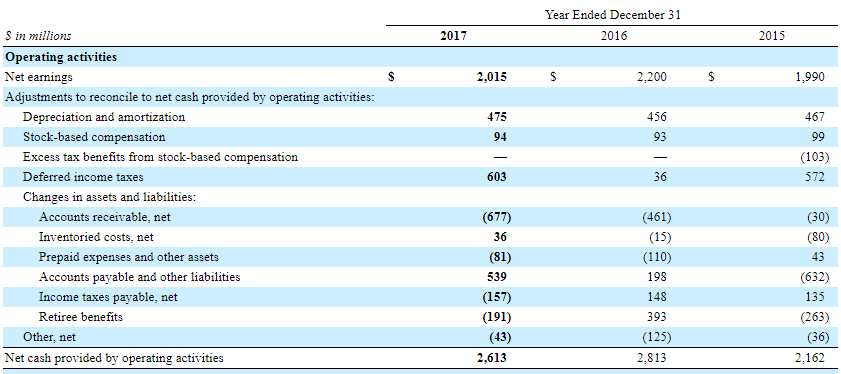

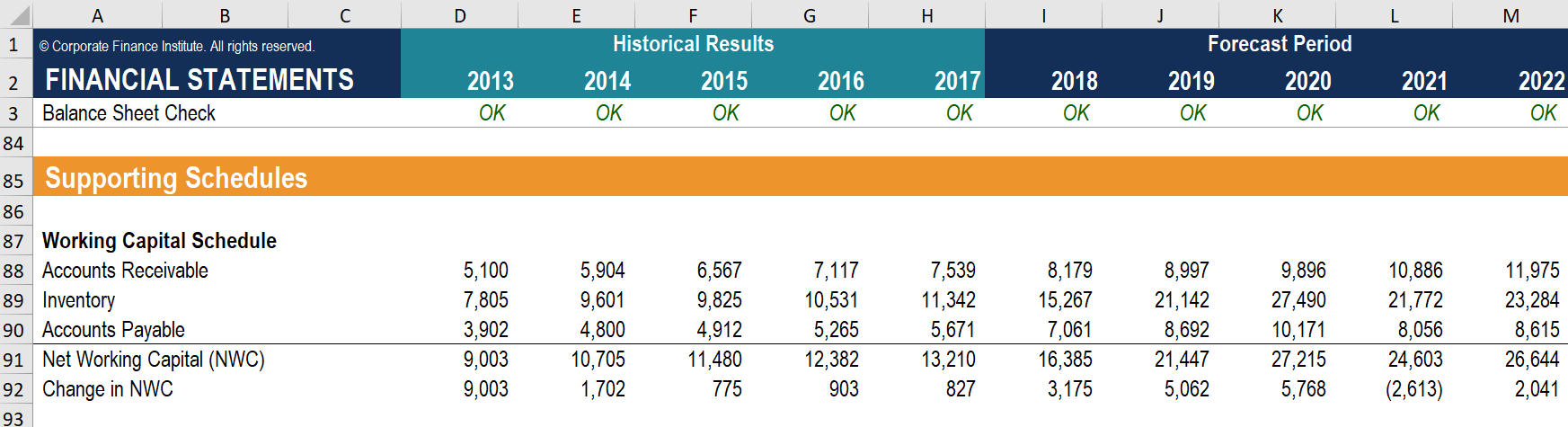

In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year. Step 4 Capital Expenditures. If the price per unit of the product is 1000 and the cost per unit in inventory Inventory Inventory is a current asset account found on the balance sheet consisting of all raw materials work-in-progress and finished goods that a is 600 then the companys working capital will increase by 400 for every unit sold because either cash or accounts receivable.

Change in Working Capital 10000. Imagine if Exxon borrowed an additional 20 billion. Depreciation and Amortization.

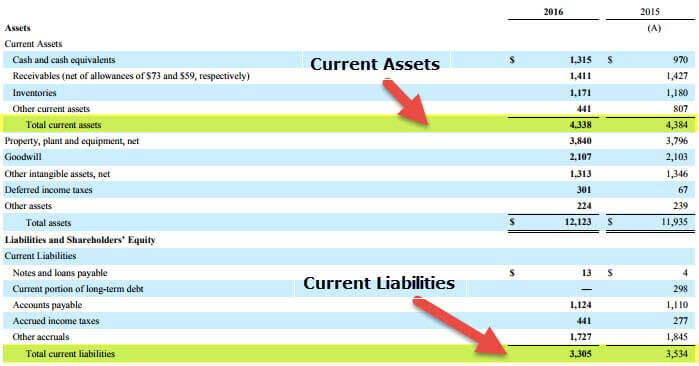

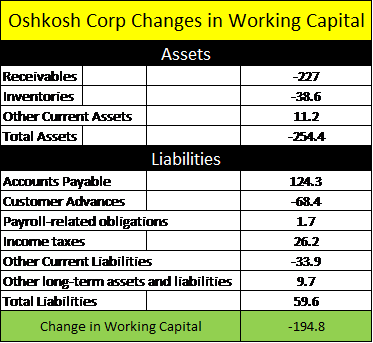

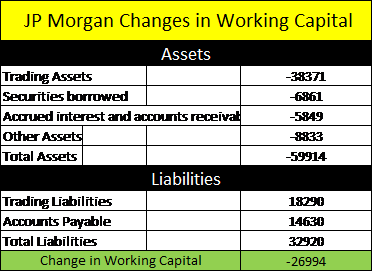

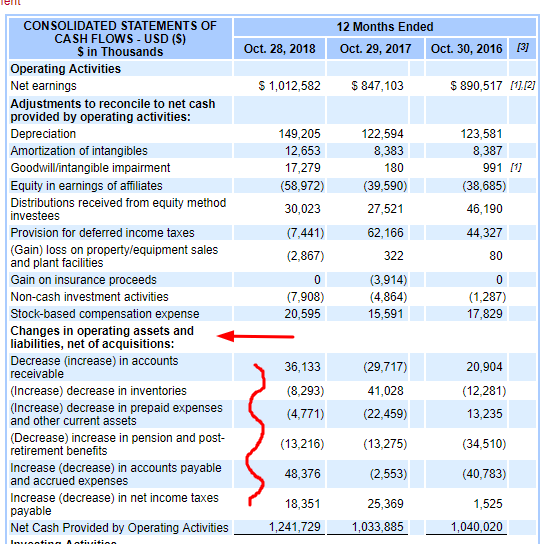

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. Since ongoing investments in accounts receivable inventory and fixed assets are typically essential to the continued operations of a business it is common to adjust free cash flow forecasts to reflect working capital changes. The working capital has increased by the value of the inventory 3000 but there has been no corresponding increase in accounts payable so the net change in working capital is 3000 reflected by the cash flow out of the business -3000 to pay the supplier.

Working Capital The Gap. Change in Net Working Capital is calculated using the formula given below. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period.

2017 current period. Change in Net Working Capital NWC Prior Period NWC Current Period NWC. Its inventory turnover was 45 times during the year and its D50 was 36 days.

Any changes in current assets other than cash and current. Randis operating cash flow formula is represented by. Net Working Capital Formula.

Operating Cash Flow 221 million. The change in working capital is positive. Actual working capital increases.

Net Working Capital Current Assets less cash Current Liabilities less debt or. Cash flow is reduced. Net Working Capital Current Assets less cash Current Liabilities less debt Formula 2.

Regardless of the formula they used the investor could determine that the amount of future assets is. A companys working capital is a core component of financing its operations. Image by Sabrina Jiang Investopedia 2020.

Change in Net Working Capital 12000 7000. A company uses its working capital for its daily operations. Cash flows from operating activities.

Changes in working capital. Working capital is defined as current assets minus current liabilities and for this blog we are assuming that the subject company utilizes an. Cash flow is increased.

Operating Cash Flow 352 million 32 million 65 million 98 million. Subtract the change from cash flows for owner earnings. As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year.

Thus the formula for changes in non-cash working capital is. Changes in working capital simply shows the net affect on cash flows of this adding and subtracting from current assets and current liabilities. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable.

Operating Cash Flow Operating Income Depreciation Change in Working Capital Taxes. Net change in working capital-30000. They could also use the second formula to create the equation below.

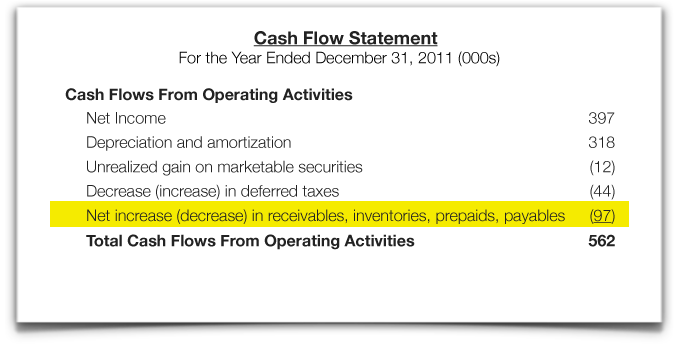

Effect on cash flow Change in working capital. Adding to the confusion is that the changes in operating activities and liabilities often called the changes in working capital section of the cash flow statement commingles both. This can be summarized in the change in working capital formula below.

Net Working Capital Current Assets Current Liabilities. Change in NWC Formula. That means in a typical year Randi generates 66000 in positive cash flow from her typical operating activities.

Net Working Capital Accounts Receivable Inventory Accounts Payable. Net Working Capital Current Assets Current Liabilities. Ie Asset increase spending cash reducing cash negative change in working capital.

Working capital is a balance sheet definition that only gives us a value at a certain point in time. You can calculate the change in net working capital between two accounting periods to determine its effect on the companys cash flow. Change in Working capital does mean actual change in value year over year ie.

There would be no change in working capital but operating cash flow would decrease by 3 billion. The non-cash working capital for the Gap in January 2001 can be estimated. Remember that working capital current assets current liabilities.

85000 0 9000 -10000 66000. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. AP accounts payable.

Working capital Working Capital Formula The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. The business has net income of 70000 but the net increase in working capital of 30000 reduces the operating cash flow to 40000. Changes in working capital is an idea that lives in the cash flow statement.

2016 prior period. It means the change in current assets minus the change in current liabilities. Thus the formula for changes in non-cash working capital is.

Non-cash working capital receivables inventory payables. Non-cash working capital 10000 200000 25000 30000 Non-cash working capital 155000. Depreciation accounts for the reduction of a current assets value over time while amortization means spreading the cost of an intangible.

An increase in net working capital reduces a companys cash flow because the cash cannot be used for other purposes while it is tied up in working. Represents the difference between a companys current assets and current liabilities. Net Income is the companys profit or loss after all its expenses have been deducted.

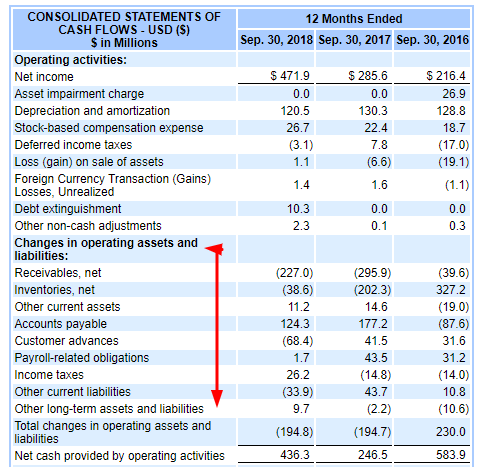

Working Capital on the Cash Flow Statement.

How To Find And Calculate Changes In Working Capital For Owner S Earnings

How To Find And Calculate Changes In Working Capital For Owner S Earnings

Change In Working Capital Video Tutorial W Excel Download

How To Find And Calculate Changes In Working Capital For Owner S Earnings

What Is A Cash Flow Statement What Are The Three Sections Wikiaccounting

Change In Working Capital Video Tutorial W Excel Download

Why You Need To Adjust Operating Cash Flow For Working Capital Changes Seeking Alpha

Cash Flow From Operations Definition Formula And Example

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Cash Flow Statement How A Statement Of Cash Flows Works

Introduction To Financial Statements Cash Flow Statement The Kaplan Group

How To Find And Calculate Changes In Working Capital For Owner S Earnings

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator